DeFi Weekly Report | Week 44, 2021

A bird's eye view of the money flows across blockchains and within each DeFi building block.

👋 Hey! Welcome to the “DeFi Weekly Report” series of Coin98 Analytics.

We will publish this report weekly to provide you with a bird's eye view of the money flows across blockchains and within each DeFi building block. Subscribe to get this newsletter every week. 👇

Together with Coin98 Wallet

Coin98 Wallet is a leading Multi-Chain Wallet & DeFi Gateway that allows users to store, send, swap and access a wide variety of DeFi services on 30+ blockchains such as Ethereum, Binance Smart Chain, Solana, Polygon, Avalanche, and Terra at ease.

On-Chain Metrics

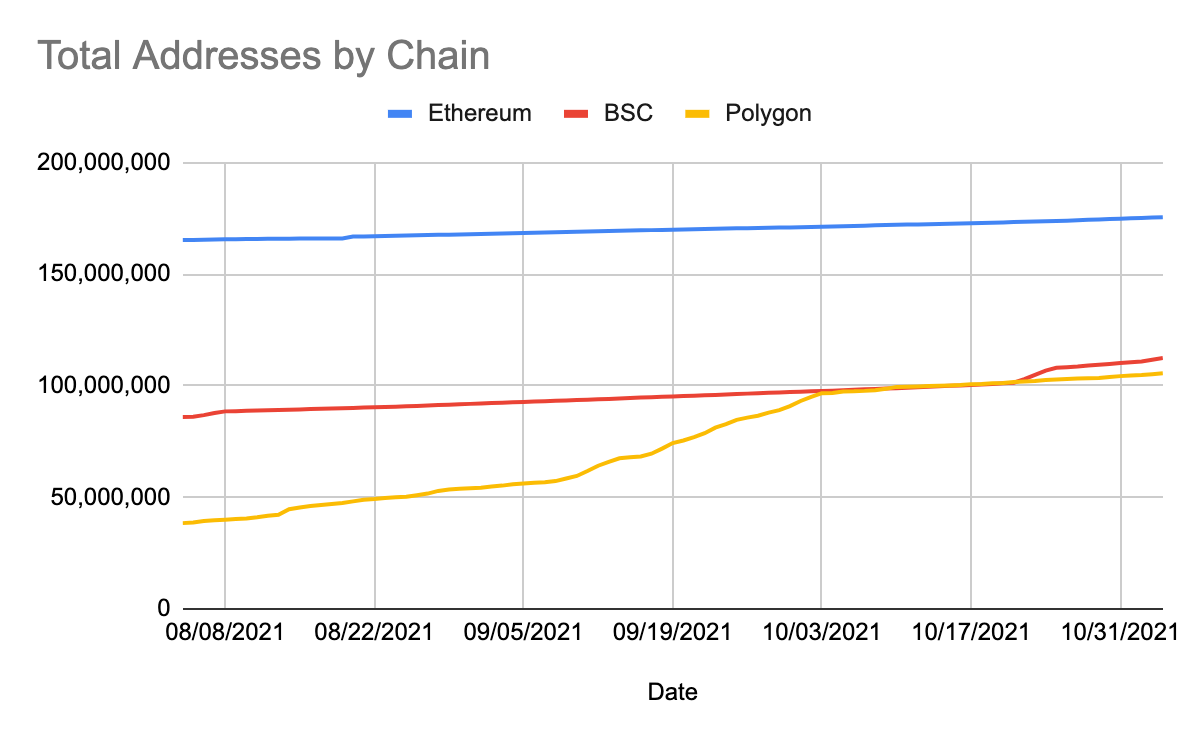

Total Addresses

After peaking in the number of addresses created, this week, Binance Smart Chain and Polygon are up only slightly by 3% and 2.11%, respectively.

Binance Smart Chain had a spike on November 3rd and November 4th at 760,000 addresses per day. This figure of Polygon has not changed too much, at 200,000 - 400,000 addresses per day.

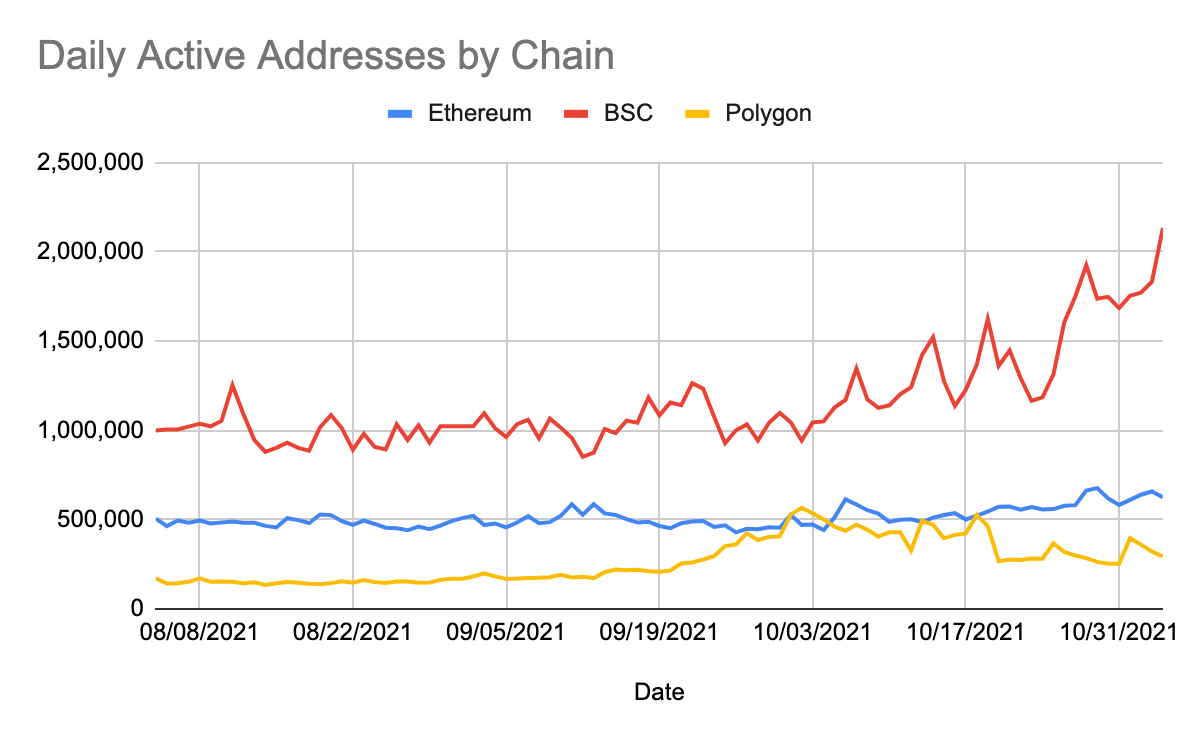

Daily Active Addresses

Binance Smart Chain's daily active addresses continue to reach ATH at 2.1 million addresses/day, equivalent to an increase of 10.9%, compared to the previous week. Meanwhile, Ethereum and Polygon still have no significant fluctuations in the number of active addresses.

Daily Transactions

The daily transactions of Binance Smart Chain increased sharply to the previous ATH, at 12.18 million transactions/day. While Ethereum has an average number of transactions of 1.3 million/day, this number of Polygon tends to decrease, currently at 3.4 million/day.

Layer 2

Layer 2: Total Addresses

Total addresses of Layer 2 are growing slowly. Arbitrum's total addresses are 248,500 wallets while this figure for Optimism is 222,200 addresses.

Layer 2: Daily Transactions

The daily transaction volume of Arbitrum and Optimism is relatively low, only about 20,000 - 25,000 transactions/day. This number, compared to the ATH level, has decreased quite a lot. With this amount of transactions, we can easily see that Layer 2 does not have many users.

Layer 2: Total Value Locked

Arbitrum's TVL hit a new ATH of $2.88 billion, increasing more than 11.7% from last week. Optimism and Boba network also increased strongly, specifically:

Optimism: $485 million (+71.54%)

Boba Network: $78 million (+79.68%)

Decentralized Finance

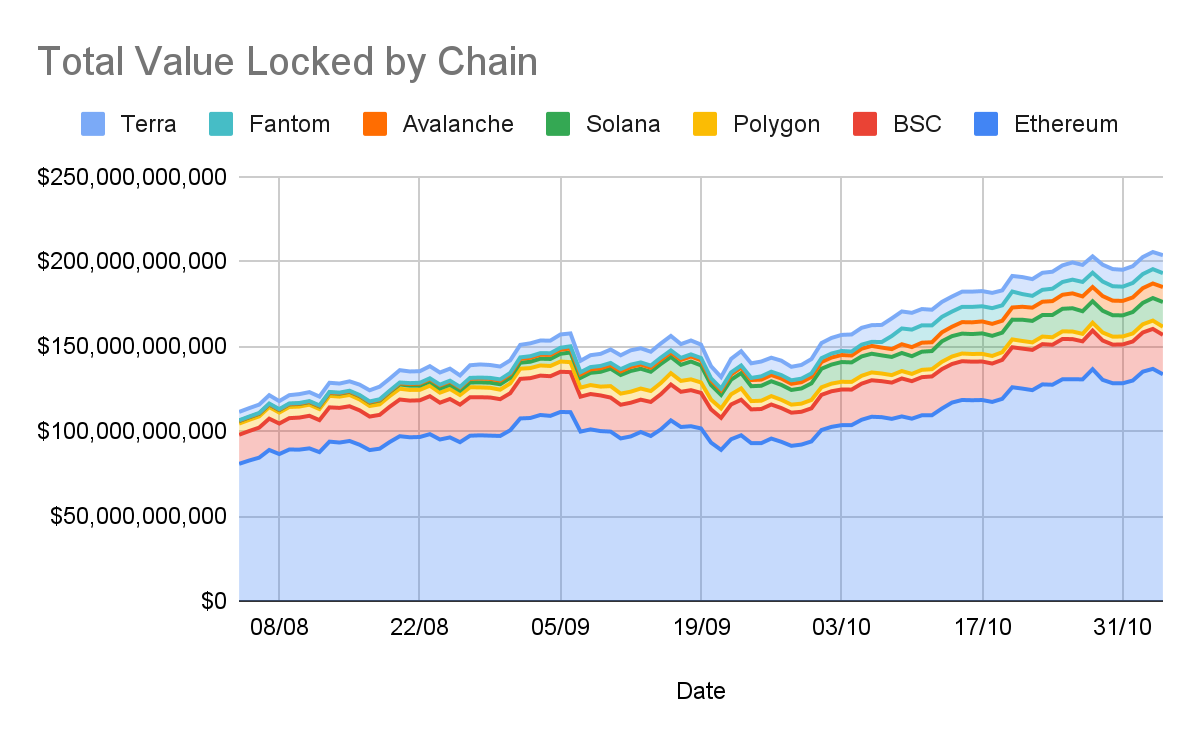

Total Value Locked

This week, Total Value Locked slightly increased by 0.34%, which has surpassed the $203 billion mark compared to the previous week.

Solana's TVL continued to grow strongly and reached ATH at $14.5 billion (+15.2%), Terra started to surpass $10 billion, Avalanche followed closely with $8.8 billion. Polygon has yet to have an apparent growth, while Fantom is showing signs of decline.

Total Value Locked by Category

Ethereum

Ethereum's Total Value Locked surpassed the $133 billion mark this week. With more than 66.88%, Lending and DEX are still two sectors that account for almost all of the money flow in Ethereum. Sector Derivatives has raised TVL beyond $10 billion, a good sign for this Sector in Q4 2021.

Binance Smart Chain

This week, TVL of Binance Smart Chain has not yet grown enormously, which can be seen when Binance is focusing on GameFi projects. DEXs and Lending still dominate DeFi on Binance Smart Chain, accounting for 76.37% of TVL. After reaching ATH at $2 billion, Sector Derivatives' TVL is showing signs of decline.

Solana

This week, Solana's Total Value Locked increased sharply and reached a new ATH, at $14.5 billion. DEXs continue to grow steadily at $7.4 billion, TVL of the Asset Sector increased strongly again. At the same time, Lending Sector’s TVL increased strongly and reached $1.77 billion (+74.25%), which is a good sign for Lending on Solana in the near future.

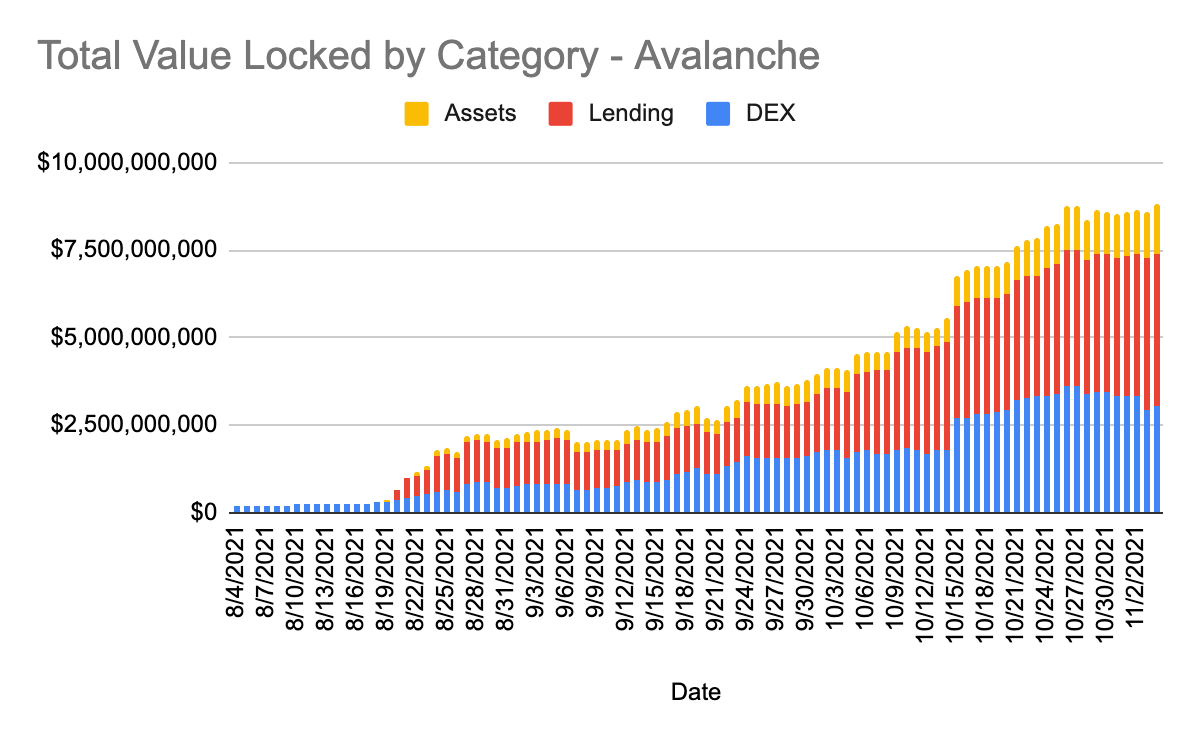

Avalanche

Avalanche's TVL is constantly breaking ATH, which is currently at $8.8 billion. Lending has a higher rate than both DEXs and Assets.

Fantom

Fantom's TVL has a massive disparity between Assets, Lending, and DEX. Specifically, the TVL of Assets is larger than the total TVL of Lending and DEX by about $600 million.

Polygon

Polygon's TVL has not changed much for more than a month now (since September 22), remaining at around $4 - $5 billion.

Terra

Terra's TVL crossed the $10 billion mark because of LUNA's growth in the past week. With the new milestone, Terra will have positive changes in Q4, when AstroPort and Mars Protocol, two highly expected projects in the DeFi ecosystem on Terra, will launch in Q4.

A Closer Look in DeFi

Decentralized Exchange

Liquidity by Protocol

Curve Finance continues to lead in liquidity with over $16.5 billion. In second place is SushiSwap with more than $6.44 billion and 3rd place is PancakeSwap with $6.3 billion. Uniswap v2 started to reduce TVL from Mid-October, although the TVL of Uniswap v3 did not increase, indicating that Uniswap's attraction is decreasing.

This week, Trader Joe has a decrease in liquidity to less than $2 billion. SpookySwap is closely following and can surpass QuickSwap at any time. Saber, Serum, and Raydium's liquidity are very close together. They are aiming to beat Trader Joe and get close to Uniswap v3 in terms of liquidity.

Weekly Trading Volume

This week, the trading volume of DEXs has increased sharply, surpassing $43.8 billion. In which, Uniswap and PancakeSwap account for a large volume.

Specifically: PancakeSwap reached $11.6 billion (+56.71%), Uniswap reached $16.5 billion (+40%).

In addition, SushiSwap also saw a significant increase in volume when it reached $3.79 billion (+38%).

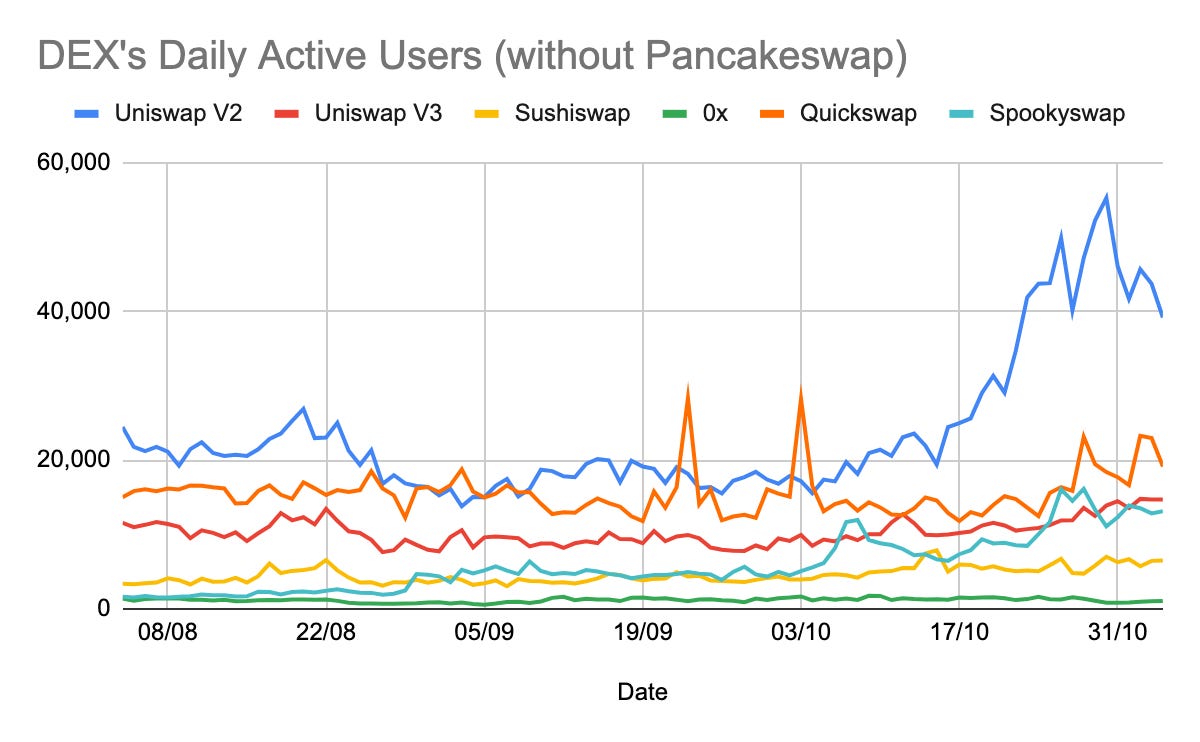

Daily Active Users

PancakeSwap continues to dominate in terms of daily active users. Currently, PancakeSwap owns 585,000 active users.

After increasing to 55,000 DAUs, the number of active users on Uniswap v2 is decreasing. QuickSwap, SpookySwap, and Uniswap v3 have a pretty close amount of DAUs, in the range of 13,000 - 19,000 DAUs.

Lending Landscape

MakerDAO continues to lead the TVL Lending sector at $17 billion. The 2nd place belongs to Compound with $12.5 billion, and Aave V2 has dropped to 3rd place when the TVL of this protocol is only $11.26 billion.

Anchor TVL has surpassed the $4 billion mark and shows no sign of stopping. In contrast, after robust growth since August, Abracadabra started to slow down this week. The most notable is Solend, currently the largest lending protocol on Solana with a TVL at $800 million.

Outstanding Loans by Protocol

Aave's outstanding loans decreased sharply from $8 billion to $6.6 billion. Compound continues to be the top spot with more than $8.3 billion. MakerDAO owns an $8.1 billion, which is very close to Compound and can surpass Compound at any time. This week, Abracadabra's outstanding loans caught Aave_matic, currently the lending protocol with the 4th largest outstanding loans in DeFi.

Derivatives (Ethereum)

The volume of Perpetual Swap trading is dropping sharply after peaking in early October. Specifically, the volume of dYdX L2 has fallen from $8.2 billion to $2.2 billion/day, Perpetual Protocol reduced from $150 million to $85 million days.

Non-Fungible Tokens

Opensea

Opensea Volume and DAU continue to decline. Specifically, Opensea's DAU volume has reached 11,400; trading volume has decreased to $43 million/day.

Monthly NFTs Art Sale Volume by Marketplace

In October, the volume sale of marketplaces was only $193.8 million, down 39.42% compared to September. The leading position in terms of trading volume was Art Blocks with $98.8 million, followed by Super Rare with $37.1 million.

Fundraising Spotlight

About Coin98 Analytics

Coin98 Analytics is powered by the Coin98 Finance team with the motto "Let The Data Speak for Itself.” Our ultimate goal is to provide in-depth research and unique data-driven insights to the community, satisfying various demands in blockchain and crypto, ranging from investing to development.

Follow us on Twitter 👉 https://twitter.com/Coin98Analytics.